Druckenmiller at Sohn Conference 2022, Tiger Global's gambling problem, becoming bullish...

Nobody expects Persistent high inflation

Nobody expects persistent high inflation, Hong Kong Migration, Tiger Global a gambling parlour, Tavi Costa about our current Macro environment.

Good morning Coffee drinkers and tea lovers alike!

Today just a few quick thought on the market and the current environment, which I might use as a guide for the next 1-2 years. As always I am quick to change my mind if the facts change, so it might be outdated tomorrow.

Druckenmiller at Sohn Conference 2022

There are a handful of people where you listen intently when they speak. Stanley Druckenmiller is one of them. He has accumulated so much knowledge - it is incredible.

Here is what I have learned from the latest interview with him.

About the current market, trends and the future:

Inflation is quite high and as a result the asset bubble has burst with a vengeance. He is surprised how slow the Fed recognised the problem.

We are currently six months into a bear market that has some time to run. The probability of a soft landing are pretty remote. Once inflation was above 5% it never came down if the Fed rate was below CPI. Once inflation was over 5% it has not been tamed without a recession. A soft landing goes against decades of history. A recession is in the cards, but Stanley doesn't know when. As there are a lot of savings from the pandemic, consumer weakness will get masked for a long time.

The last few months where the best short selling opportunity, that he saw in his lifetime. Many companies were over-earning due to the pandemic and valuations went very high. However nearly every company is cyclical. Today shipping companies are probably over earning. Shorting is much harder now.

You should never clone as 13Fs are old data, and in their case it is true. While energy has become widely recognised, and is not a classic Druckenmiller play anymore - it is still cheap 1-2 years out and has a leg to stand on due to the lack of supply, the Russian invasion and the ESG angle. No demand destruction can bee seen at the moment.

In the 45 years of his investing, he has never seen a thing with no historical analog (Note: I believe that it is most similar to the 1940s as Lyn Alden pointed out, but I agree that there is no real blueprint here). In 2009, he thought that there won't be another financial crisis in 30-40 year, but he is not sure anymore.

He can see today be similar to the 30s. After the asset bubble burst there was a big demand destruction. If asked, he would say that the possibilities are 70% inflation and 30% deflation. Every deflation has been proceeded by an enormous asset bubble. As we know the Fed has created the biggest asset bubble that he has ever seen. Japan can still feel the consequences of the 1989 bubble. Keep an open mind, the ending is not predictable.

The last few months they made money by shorting fixed income and stocks, while owning gold, oil and copper. The current market is very challenging tho as the economy seems to be weakening. However if you get too aggressive on the short side, you will get your head ripped off during a bear money. If the market goes up 15-20%, he will be back on the short side - but he will currently sit out and won't play a lot of equities. Chances are also high that he will probably short the dollar in the next six months.

A simple allocation would be gold for stagflation, bitcoin for an inflationary bull market.

Investment style and how it evolved:

As he didn't come from an economic background he doesn't use the traditional metrics, like unemployment rate to predict the economy. Stock tend to lead the fundamentals of the economy 6-12 months. Housing has often been leading and retail is is just slightly behind. He has a bottom up approach to find leading companies and predicts the macro by listening to their earnings call.

Historically those stocks have given him good market signals. The bond market did so as well, but as it has been manipulated by the central banks the last 12 years, they do not send any reliable signals. The central banks can not taint the industries however. The state of the housing can be seen from homebuilders and trucking stocks give an indication about the health of the economy. Both are down 40% since last year, despite record earnings. Retail is more a leader than a laggard as well. As retail looks weaker than it should be during inflationary periods, there may be trouble ahead. However these are not short term prediction - they have 6 months to 1 year lead time.

In the past he acted a lot on price actions vs news. Today that is not very applicable. He also had to change his style in the 70s during the bear market to include bonds, FX and commodities to make money during a bear market. Bonds has been his go to asset class in bear markets. That can not be said today.

Put all your eggs in one basket and watch that very carefully. Contrary to business school he thinks diversification can be dangerous. Stale long or short position can kill your returns. Having all your eggs in one basket requires ruthless discipline, paranoid and constant re-evaluation. Sizing is 70-80% of the equation. It is how much you make you are right and how much you lose when you are wrong.

You need to know when you are hot, or when you are cold. If you are hot, you can go haywire. However if you are cold - you should go small. Trading rhythm is important.

Investing is an art form. Don't be a slave to past models and always innovate.

Currently invests then investigates. There is so much information and smart people, that if you don't act on a good idea fast - it is gone. Go with your intuition and macro knowledge, invest and then do the deep dive analysis. In 10 days, when you are wrong - you probably don't lose a lot.

After he made a mistake buying back into the internet stocks, he went on a four months sabbatical in Africa. Not reading news or the market. When he came back, the Nasdaq and S&P 500 where still close to the highs. Meanwhile the oil, dollar and interest rates where all rising. That mixture has historically been bad for company earnings and the markets. The small business owners that invested in his fund all told him that their business was terrible. While earnings where down 35%, estimates were still up from analysts. Even though he was on a cold streak, due to his sabbatical he had a fresh mind. He went long treasuries and made 40% in the 4th quarter of 2000, erasing the 18% loses early in the year.

If you are young, you need to be passionate to get great results. The next 4-5 years are tailored to his skillset. In order to profit, one needs to learn macro, different assets classes and how they integrate. Think what moves the stock price and how people will think in 12-24 month and not what they think today.

Macro traders are naturally bearish. Bonds and FX move as things start to get messy, so you make all your money. As a result he has a bearish bias. However, even the best short teller will tell you that they made 90% of their money on the long side.

Tiger Global's gambling problem?

Tiger Global, the hedge fund that managed to ride the tech boom like few others, was down 52% this year and the long-only fund was down 61.7%.

Those numbers are staggering. The company invested into high-growth stocks with insane valuations and low, or no profitability. Ironically Julian Robertson, the founder of Tiger Global went into retirement as he predicted the collapse in internet and technology stocks early 2000, but could not take the loses any more.

Being down 52% would be unacceptable for many value investors, as there probably would be something unexpected, but it is outright scandalous for a hedge fund. Not only did they not take a lot of profits, but they also did not protect their investors capital with hedges. If Tiger Global act like a 3x levered Nasdaq index, why invest in them?

What enrages me, is that the fund is now concentrating on fewer stocks, focusing more on shorting and buying in areas where the prices has fallen too much, like in Chinese EV stocks. It seems that they can not stop the gambling. Chinese EV stocks might have fallen, but that does not make them cheap and what will make them go up? With consumer confidence weakening and the saving rate being obliterated, it does not look like a great opportunity for car companies. Additionally, they are concentrating on fewer stocks, when they are on a bad streak. Druckenmiller said, that when you are cold - you need to earn the right to make big bets and concentrate - being profitable with small positions. What Tiger Global is doing, is dangerous and it increases the chance of a blow up.

Nobody expects Persistent high inflation

Looking at all the assets and bond market, no one seems to price in inflation that is 4% or higher for 2 years or more. Everyone seems to believe that inflation will come down at the end of this year.

I believe that the YoY change in inflation has peaked now, but that is mainly because there has been stronger inflation in June and July 2021, then in May.

However I don't think inflation overall has peaked. While it might not accelerate as much, there is no sign or prices stabilising. Everyone who has been to the supermarket or the pump can attest to that.

Lyn Alden has compared today to the 1940s, where there was high inflation, high debt levels but lower interest rate. The seemingly lacking response to the inflation from central bank still shock me however.

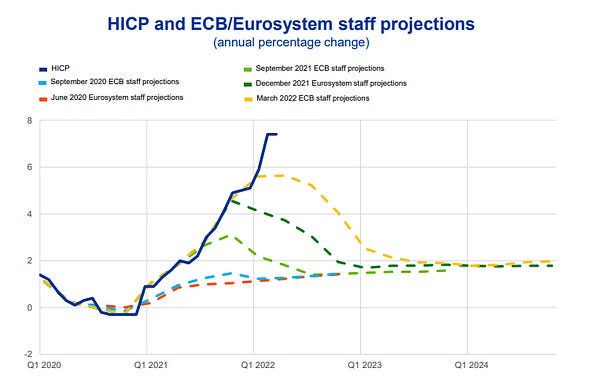

The ECB does a 0.25% hike and draws a few lines that inflations expectation will be lower. (Thanks @MacroAlf for the graphic) and so do most investors (Thanks @lisaabramowicz1 for the tweet).

I think this is wrong. We have inflation due to a mixture of the unprecedented fiscal/monetary policy and the supply chain.

In addition the Russian invasion is hugely inflationary. The market seems to think it is priced in, but Covid or other crisis and trends has shown us - that monetary policies and supply chain problems take 1-3 years to show up.

The full extent of the consequences may just be seen next year. While inflation might come down in terms of peak, it might be hear to stay.

Given a 4% inflation over the next 3 years, energy and material companies that are already cheap - would trade at around 1x FCF.

I am currently looking at ways to profit the most of it. Shorting 10 year treasury's is a bit risky if there is a flight to safety if equities markets struggle.

A diverse portfolio of those cheap energy/material stocks might do well, but some 2024 leaps might payoff much better.

I think LATM looks interesting especially Argentina, Peru and Chile. Precious metals probably also do well, but they might experience some serious price compression, due to the ambiguity of the central banks before they take off. Do you have som good ideas what sector, country or asset class other than commodities would do well?

Tavi Costa about our Macro Environment

This thread from the portfolio manager of Crescat Capital is definitely worth a read.

Hong Kong Migration

As people leave Hong Kong en masse, a lot of them migrate to Singapore according to CNBC. As I find Singapore already a very interest country for investing, I will try to find some interesting companies there.

Getting Bullish

As everyone starts to turn into a bear, I start to hunt for great companies. Silver is of great interest to me, as it would benefit from long-term inflation with low rates. I need to do a lot of research tho, until I find companies that I like in that field.

I also bought a position in Fairfax - a company that is often called the Berkshire of Canada. Here is a great writeup.