International Opportunities #1: Thungela Resources - Coal isn't dead

Everyone hates coal, but current regulation could create similar results to tobacco from 1990-now.

This piece is an opinion and for information purposes only, and it isn't investment advice. Seek a duly licensed professional for investment advice.

Housekeeping

Hello! I have decided to create a new format for my newsletter. As the US is such a big player in the stock market, investors often overlook other parts of the globe. Those parts sometimes offer great bargains. I will quickly outline an opportunity. The report is in no way a deep dive and needs much further investigation before investing. I share what I think might be an exciting stock. Those weekly columns will have the following structure:

Introduction

Quick Thesis

Problems

Conclusion

As always, feel free to contact me on Twitter @InvestRoissor leave your comment below.

Disclaimer: I am long the company.

Introduction

The company is a coal producer in South Africa. To improve their ESG ratings, Anglo American has recently spun off their coal sector to form Thungela. The company is on the London and the Johannesburg Stock Exchange (TGA.LSE / TGA.JSE).

With a market cap of just $714.72M (End of September), it is the size that flies under institutions' radar. Others won't own it because it is coal. As the energy source is deeply unpopular with ESG investors, hardly any fund managers want to take the risk to own it.

The company has FOB cost per export saleable tonne of $51/t. Power Plants currently switch natural gas for coal due to natural gas exploding in price. That changes the power distribution considerably, with coal being the primary electricity source in Germany in the first half of 2021. As a result, the price of coal has also rallied.

The company's income wasn't high in the last few years. However, as coal prices are more than double and sometimes triple what they were the last few years, the effect could already be seen from the rising coal prices in Q2 2021. The previous quarter realized coal prices of around $65 for the company. Their adjusted EBITDA was at $124m.

With current Richards Bay thermal futures prices, the company would make its market cap in profit after tax in around 12 months. It used to be even quicker, but the stock price was climbing steadily with a big rip last week.

The company said in an earnings call that they want to pay out around 30% of the free cash flow they generate as dividends. At current stock prices, this would result in a dividend yield higher than 15%.

Andrew Cosgrove, a Bloomberg analyst, published two graphs on Twitter comparing Thungela to other coal producers. Even if you consider the 50% price appreciation since Andrew published the graphs, the company's valuation is still low.

Isn't coal dead?

With recent developments in climate activism, it is easy to believe that coal is dead. Don't get me wrong; I'm not too fond of coal as an electricity source either. It is dirty and a huge polluter. But - it's cheap to mine and to burn. As a result, it is still very much at the forefront of electricity generation.

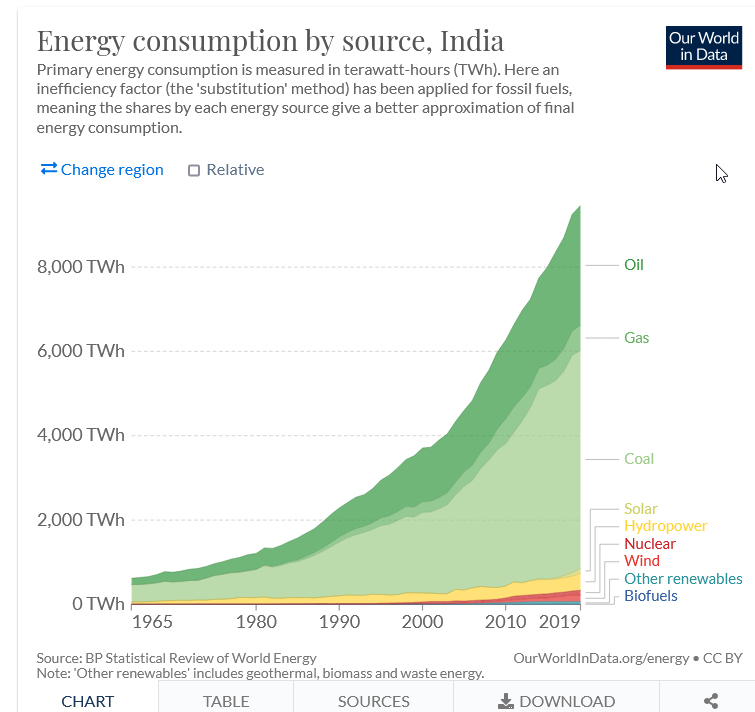

If we think about global energy consumption, we might think of it like this, with renewable starting to grow while coal is declining.

The problem is that this graph is in percent, not in total consumption. Looking at the chart below, we see that the world doesn't seem to exchange one energy source for another, and it just gets stacked on top.

Absolute coal usage will increase with India and Southeast Asian countries looking to push towards higher living standards.

Business magazines like to state China as a country with high coal usage that peaked in 2011 and is now scaling down. However, that is not true. According to the IEA, China's demand for coal is still increasing.

As a result, much more of the global electricity comes from coal than many expect, and was the biggest electricity provider in the world 2019.

While demand is still increasing, supply is going down. The United States coal production slumps to volumes last seen in the 1960s. As coal production in Eurasia, the European Union, and South Africa is declining, there might be an even more significant supply/demand discrepancy than what we are already seeing. Permits for new coal mines have become pretty much impossible in most western countries. The returns of coal companies in the next decade might be similar to those of tobacco companies from 1990-now.

Problems

Just with any investment, there are always problems. Nobody likes coal, and with countries trying to shift away, investing in commodity miners would not qualify for the coffee can approach. While there is an energy crunch developing in Europe and China, those trends can quickly reverse plummeting the prices of both natural gas and coal.

Another problem is that the South African government wants to introduce a law that would require much higher environmental repair payments from coal companies. This proposal has been floating around since 2015, and the Thungela Resources CEO has been very confident during earning calls that it won't materialize any time soon. However, if there is a more significant push towards cleaner energy in South Africa, this might cut deeply into the margins of Thungela Resources.

Conclusion

This company is not for the person who is in search of a great compounder. I predict that coal will continue to have huge price swings as the supply/demand equation battle with the want for cleaner energy sources.

For me, the risk/reward is just too high to overlook. As I already have some coal exposure in my Portfolio with Peabody Energy, I use the position in Thungela Resources to remove legislation risks in the US.

This report is my opinion. Do your own due diligence and comment with your research.

I agree with you coal is not dead yet and I Thungela is very attractive in my opinion.

I also took a look at the company and the cash flow production looks very attractive even with the possible downsides relating to supply chain issues and possibly higher environmental liabilities.

https://deepvaluedabblings.substack.com/p/thungela-resources-limited?r=rcv5a&utm_campaign=post&utm_medium=web&utm_source=