Quantitatively wadding through Hong Kong small caps, cutting my offshore positions and improving Japanese shareholder returns...

I might already be wrong after one week and some macro thoughts

'This piece is an opinion and for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.'

Hello everyone 👋!

I have started a Substack Chat, where you can ask me anything. Just click here.(you need the Substack Reader App for iPhone/Android).

Ten days ago, I made the prediction that Chinese Internet stocks will be the best performing asset class in 2023. Well, I might be wrong already. China has moved to take golden shares in Alibaba and Tencent, giving them more voting rights and a firmer grip on the two biggest Chinese companies. Fundamentally and technically the thesis is still intact, but we'll see how that turns out.

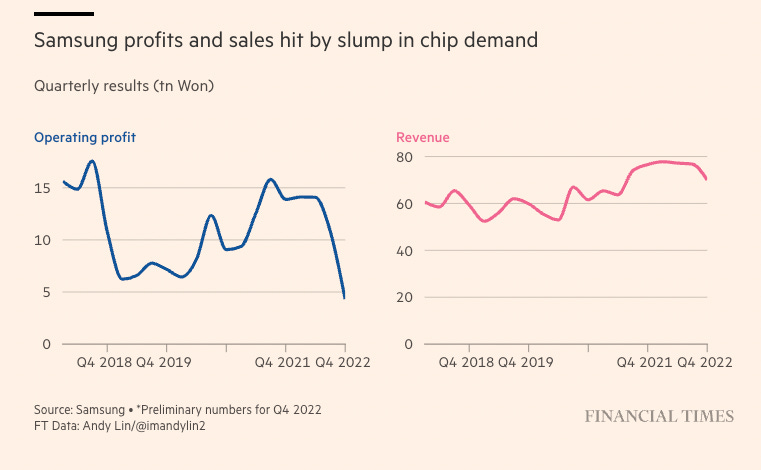

Samsung's profits have taken a large hit among lower chip and smartphone demand. I believe that this will influence both Apple and Nvidia as well.

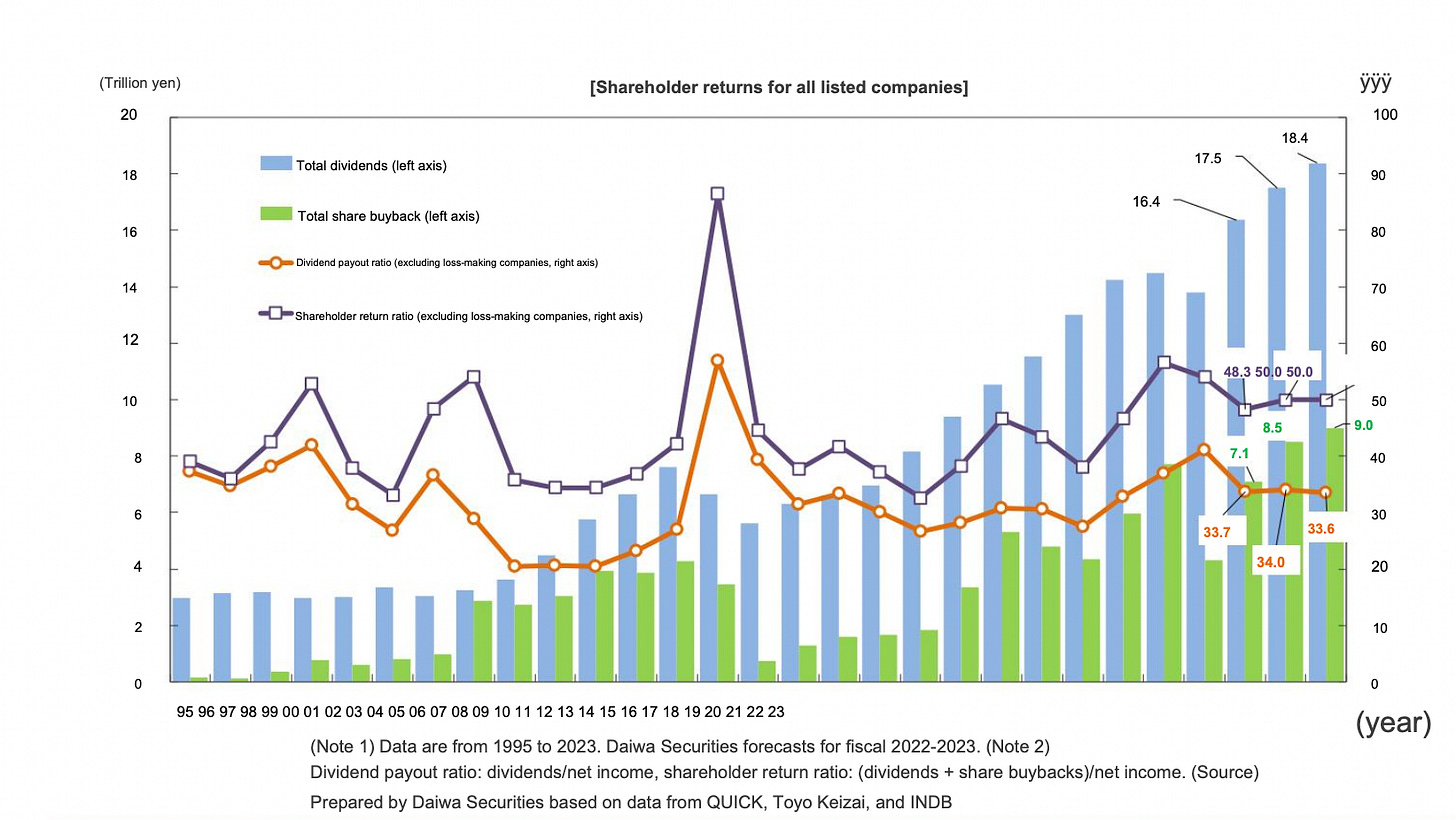

Improving Japanese Shareholder returns

In other news, Japan shareholder returns through dividends and share buyback hit its record high the third year in a row. With improving corporate governance, shareholder returns have improved dramatically. I have added a translated graph, the original is in the link.

Macro thoughts

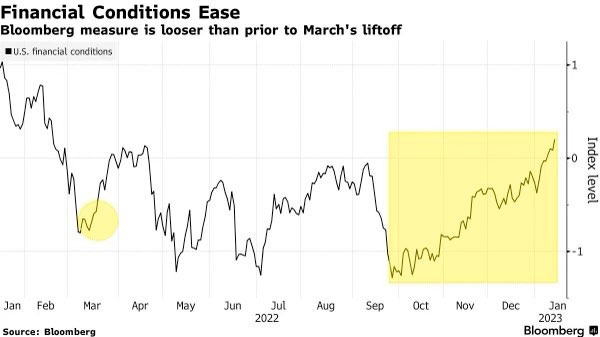

My macro thoughts are usually wrong, but I will write about them anyway. Financial conditions have eased significantly, being looser than in March 2022. The market does not buy that the Fed will stay the course with high interest rates. I don't think the central banks will be very happy about that.

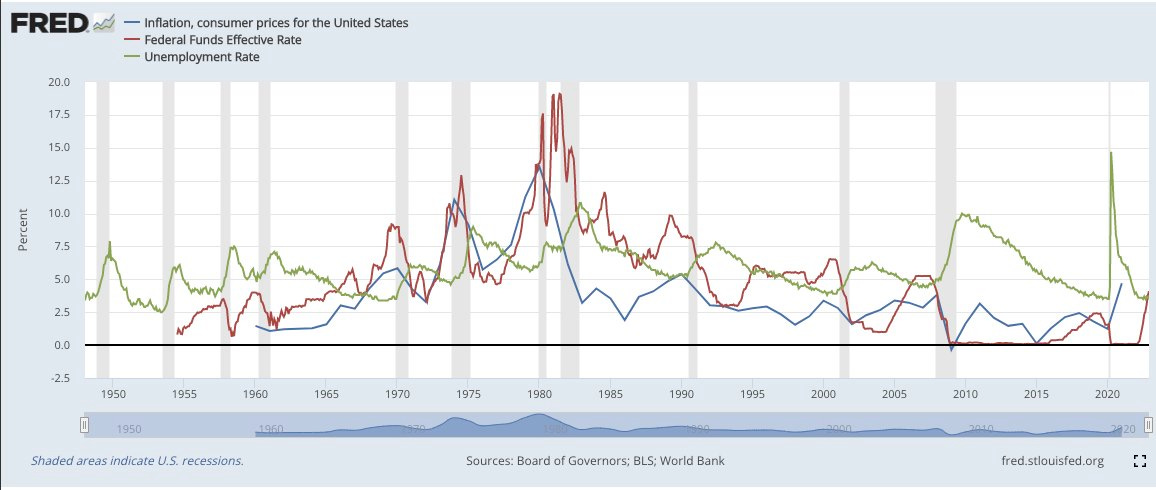

While inflation has certainly peaked, the root of it - energy supply and an extremely tight labor market - hasn't been solved. Powell does not want a repeat of the 70s, where after easing conditions, the second wave of inflation was much worse. Volcker ultimately hiked interest rates to more than 20%, inducing a heavy recession with around 10% unemployment. The US has a record unemployment number of less than 3.5%, so they do have some room to tighten.

Wadding through Hong Kong Small Caps

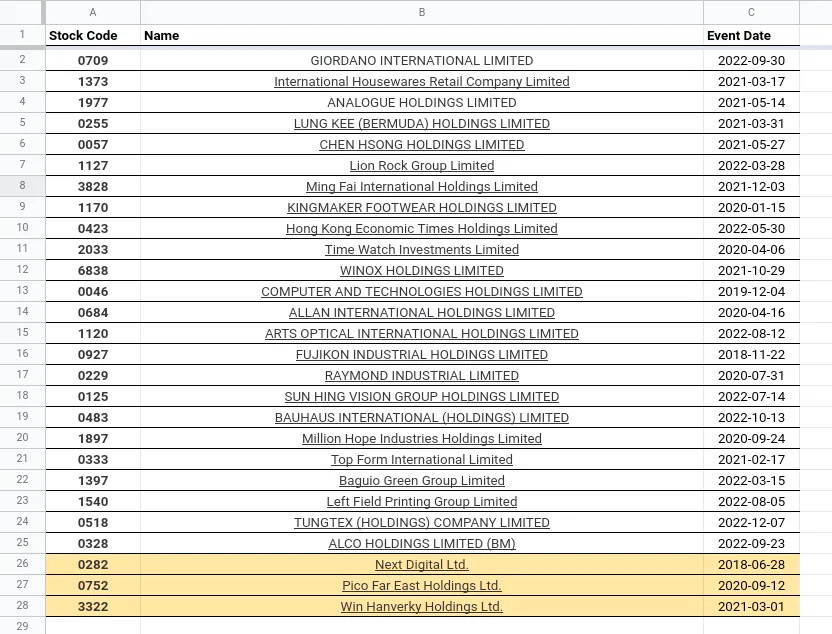

Last week, I wrote about finding David Webb's portfolio, as we share a position on Lion Rock Group. Here are his holdings (with stocks he used to hold, but might not anymore in yellow).

When I screened the Peter Cundill way for stocks that have a P/B smaller than 6, more than 6% dividend yield and less than 6 P/E - I sorted out most companies based on qualitative factors or my ability to assort their future cashflows. Today I am trying something different, a quantitative approach.

I have been burned by non-US companies that didn't pay a dividend or a buyback, so I will remove any that don't return value to shareholders. I will also remove Bauhaus International (thanks searching4value for your article) and Allen International Holdings, which were more liquidations play which have played out by now.

The first valuation, I will use, is the Graham Number. Hong Kong seems to have an ever lasting discount, so instead of 22.5 (which is a combination of P/E and P/B for Graham), I use 16, a 30% discount. Due to the pandemic, I also use a 5-year average for EPS. The companies are on the value side, not the growth one - so this approach still fits.

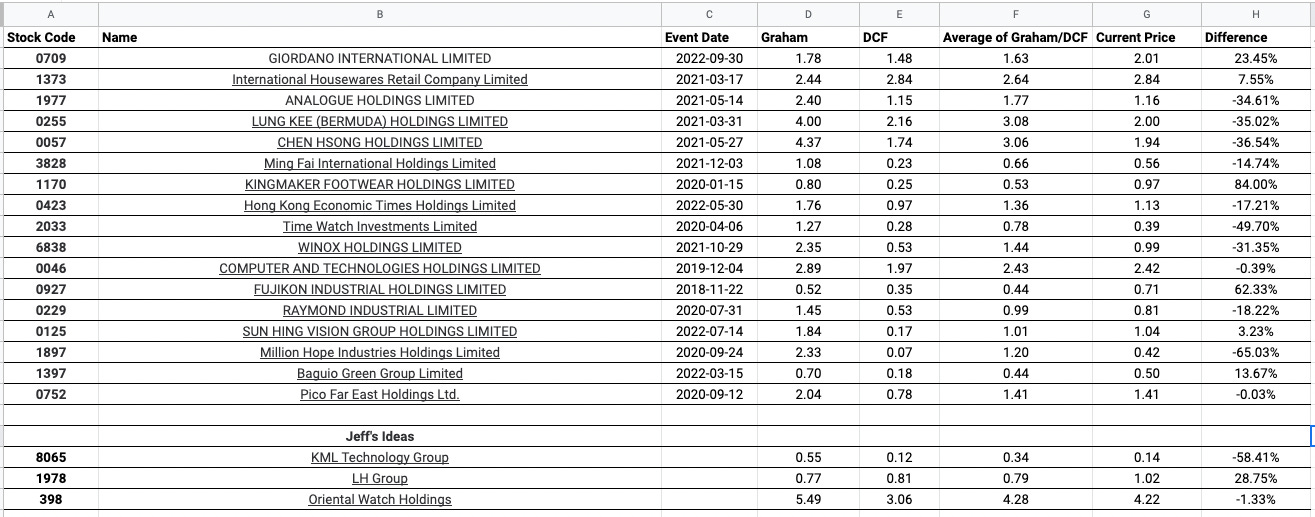

The second valuation will be using a very conservative DCF, using either the average growth from the last 10 years, last 3 years or last 5 years - depending on which is lower, requiring a 15% rate of return and using the 10-year average multiple. Furthermore, I added three stocks that I got from chatting with Jeff. These are KML Technology Group, LH Group and Oriental Watch Group. After doing Graham and DCF valuation, I then take the average and compare them with the current price.

Here is the list:

Now, I will remove all companies which current price is above the average of the Graham/DCF number, which leaves us with 12 stocks.

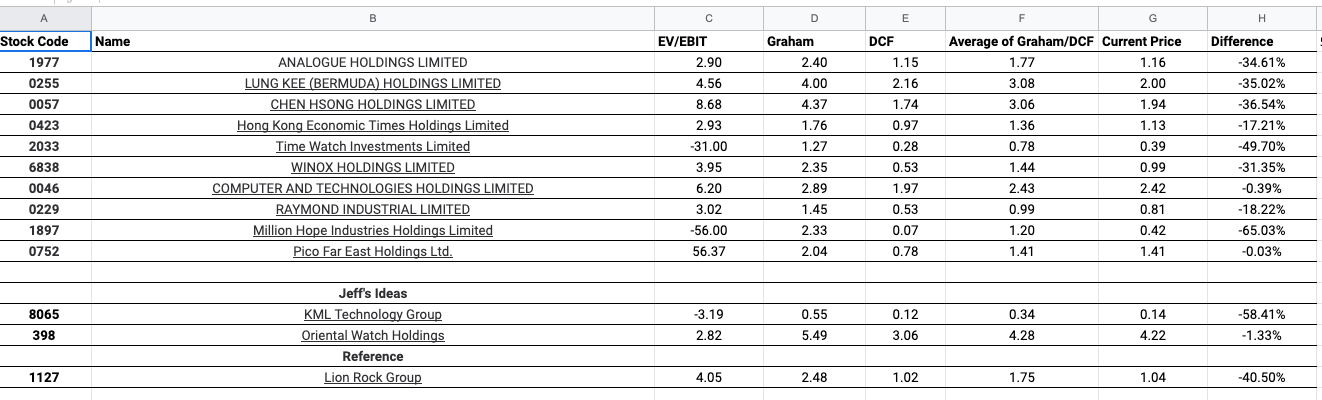

I have added Lion Rock Group as a reference. I don't look for great companies at a fair price, I look for fair companies at a great price. That means I will rank the companies according to the price difference between my valuation and the current stock price and combine that with a ranking of EV/EBIT. Since Lion Rock Group is my reference, I am removing all companies that fair worse than it. That leaves us with five companies, of which two are Jeff's ideas:

Analogue Holdings, Time Watch Investments, Million Hope Industries, KML Technology and Oriental Watch Holdings.

Since I approached it from a quantitative standpoint and not a qualitative one - I will equal weight the five position and add them to my portfolio. After one year, I will check if my qualitative approach has added anything, or if the purely quantitative strategy outperformed me.

Cutting my offshore positions

After a huge rally the last few months, I have reduced my exposure to offshore drilling names to basically zero. I thought: if they were to go down 40% now. What would I do? Since I did not know the answer, I sold and need to do more research. Long term, these companies will deliver good results. But I am in search of what gives me a certain result in 18 months to 3 years.

Furthermore, Transocean (RIG) might be a good short here. It has had a few gap up days, and I believe that recession fears and a down-turn in oil will likely return this year. Additionally, the company has an ATM offering, which allow them to raise capital in the market. Given their past ATM prices, it is very likely that they will distribute more shares soon. Now, I would not go short Transocean via the common stocks, but via a small position in puts. This stock can easily double or half and it would be risky. As my allocation to energy is quite large already, this is also a hedge. I will also move some of the proceeds from the sale towards a small position in Vornado Real Estate Trust (VNO). The price is at a 1999 and 2008 low, and I conservatively estimate the NAV (if you sell all the properties and pay off everything) at more than 10b. With the market cap at 4.47b, it is cheap enough.

Thanks for reading! I recently asked this on Twitter and has gotten some great answers. I will write about it in the next article: