The Bubble Tea Market | Nayuki Holdings and interesting Midcaps in Hong Kong

An overlooked eastern consumption trend.

Hello,

Today I will quickly write about my Hong Kong Mid Cap buys and then look at the bubble tea market and the company Nayuki Holdings. Bubble tea is a section that has been very much ignored by investors due to the lack of publicly available companies despite huge growth. It has also been very much ignored in the West, given that it is mostly an Asian phenomenon (which is slowly changing).

Mid Caps I bought in Hong Kong

Tianjin Development Holdings 882.HK trades at 0.14x P/B. It is a pure mean reversion trade. Quercus fund thinks that is is worth 6-11x more than the current market price. I disagree with that optimistic of a projection, but just based on mean reversion, the stock should be up 3x.

SmarTone Telecommunications 315.HK: The company trades at under 5x EV/EBITDA with a stable customer base. The company has over 8% dividend. They also started to buy back some stock.

Cafe de Coral 341.HK: Pays a decent 5% dividend and has returned to growth after years of slowdown. The companies earnings are still significantly lower than 5 years ago, at current earnings it trades at 7x EV/EBITDA if it recovers it would trade at around 4x EV/EBITDA. The company is an absolute staple in the Hong Kong fast food market, so not a lot has to go right here.

JNBY Design 3306.HK: Fast growing ad company at 7x P/E that pays 8% dividends. Has a decent customer base and is expanding fast.

E-Commodities Limited 1733.HK: Coal trading company at 1x EV/EBITDA. Earnings will be lower this year as the coal price normalises, but they buy back a significant amount of shares and had a 10% dividend

G&M Holdings 6038.HK: This is a super small company (and not a mid cap, so careful of the liquidity). Facade renovation company at negative Enterprise value. Earnings have been growing and they recently bought stock in a Mongolian coal mine, the stock also yields 9%.

Nayuki 2150 HK has their own niche in the bubble tea market and being at 0.7x P/TB and 0.7x P/S is significantly undervalued with long potential growth.

Bubble Tea

Bubble tea, invented in Taiwan in the 1980s, is a drink that typically consists of a tea base (mostly black, green, or oolong tea) and is either milk based or mixed with fruit flavours. It is topped with Tapioca pearls (also called boba). Tapioca is made from cassava root starch and is most often mixed with brown sugar, making it black.

Nowadays you can have the boba in many different flavours like lychee and many more and it has a gel-like texture that is sticky and elastic and thus provides a unique texture to bubble tea. The different kinds of Tapioca have become the signature of the drink.

The bubble tea market is an immense growth market. It is expected to grow at a CAGR of 18.7% from 2023 to 2028, reaching RMB 1,180.5 in market size. The main customers are in Asia, with rising consumption in the west and are 20-35 years old.

The freshly made drinks segment, also exhibits one of the highest growth rate among all segments and is expected to grow 20.3% to a USD$49.4b market just in Southeast Asia - marking it the fastest growing market among major markets world wide (taken from Mixue IPO Prospectus).

The growth has happened despite the economic downturn in China and China now has 486 000 bubble tea stores and experienced around a 40% growth in 2023. Given that growth, competition is fierce (more on that later).

Nayuki Holdings

Peng Xin and Zhao Lin, a couple who met while studying at the Jiangxi University of Finance and Economics, founded Nayuki in 2015. Inspired by the success of Taiwanese bubble tea, they created stores that were more tailored towards the high-end/premium market in China and since then the company has experienced rapid expansion.

In the first quarter of 2024, it had 1597 self-operated and 205 franchised stores. Due to rising nationalism in China, the company rebranded their stores to the Chinese pronunciation of Nayuki: Naixue in late 2022.

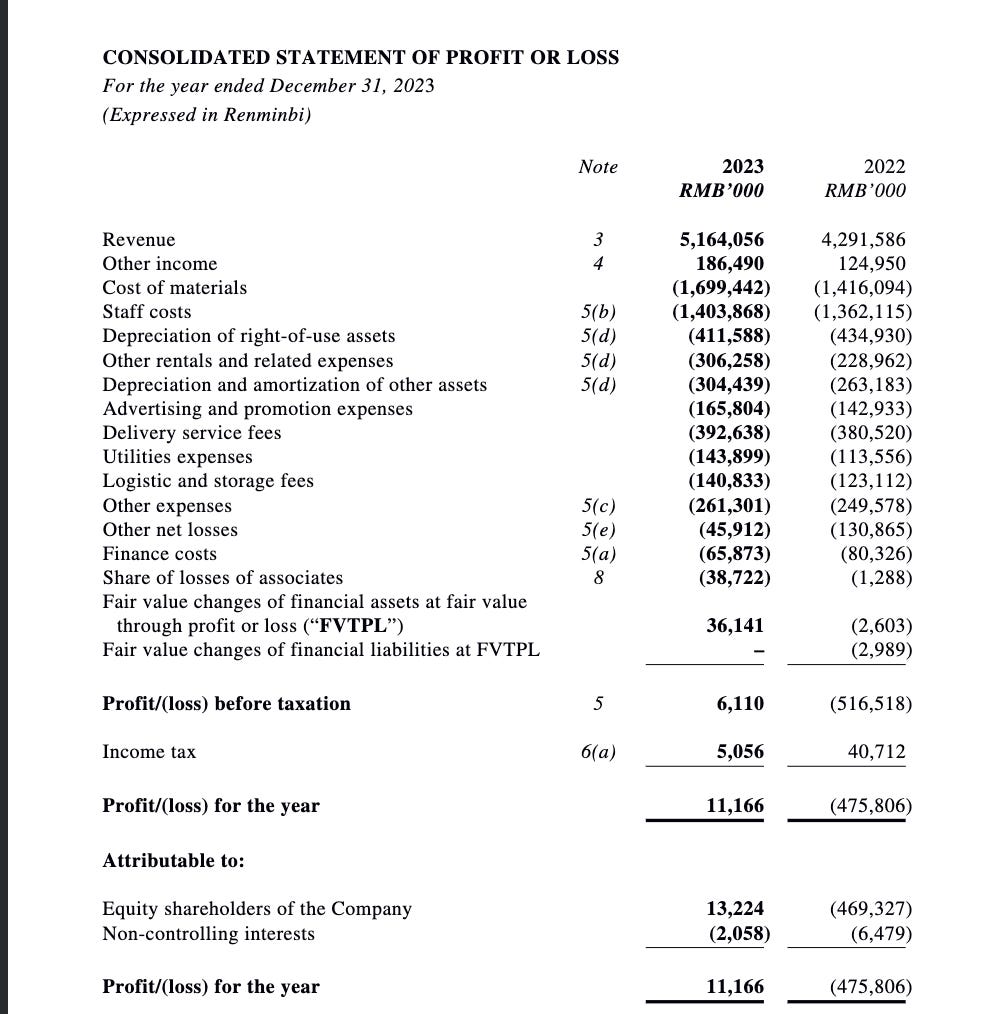

The company went public at the perfect time in June 2021 with net proceeds from the public offering being HKD$4,842.4 million. Since then the companies stock has been in a free fall, and as of writing the stock price is at HKD$2.26 - a 86.43% decline - and the market cap stands at HKD$3.88b. This is despite improving operations with revenues growing 20% in 2023 and the company achieving profitability.

The valuation in general is quite low, being 0.73x P/TB, 0.7x P/S and less than 8x EV/EBITDA. Even assuming low growth, the company can deliver 10% returns for close to a decade. The founders still own 56% of the company.

Why does the opportunity exist?

The current low valuation can be attributed to several factors:

Hong Kong stock market performance: The Hong Kong stock market has been underperforming for a decade, with the current market level lower than it was in 2009 and nearly the same as it was in 1997, before the Asian financial crisis. This overall market sentiment tends to have a more significant impact on smaller companies like Nayuki.

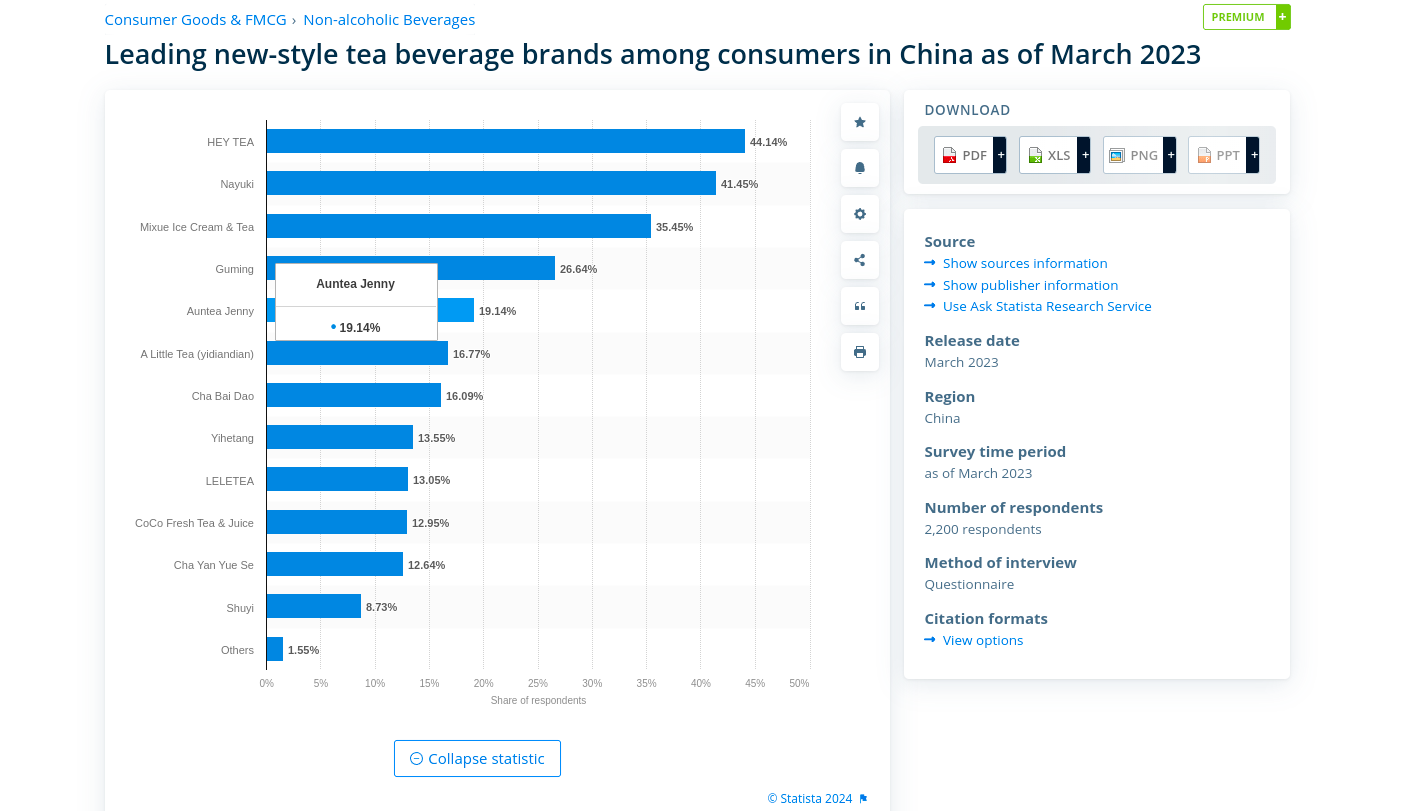

Intense competition: The bubble tea industry in China is highly competitive, with many players vying for market share. However, the market has not yet fully recognized the differentiation between these companies, which can lead to undervaluation of some brands. Just like fast food chains, bubble tea chains position themselves differently in terms of target audience, product offerings, and expansion strategies.

Reliance on self-operated stores: Unlike its competitors, Nayuki has primarily relied on self-operated stores for expansion, only starting to franchise in July 2023. While this strategy allows for greater control over brand image and product quality, it has also resulted in slower growth compared to competitors who have aggressively expanded through franchising. Despite Nayuki's revenue growth of 20%, it has lagged behind its competitors in terms of overall growth.

Lack of comparable public companies: Nayuki is currently the only publicly listed bubble tea chain, with its competitor ChaPanda set to list on the Hong Kong Stock Exchange on April 23, 2024. ChaPanda, officially known as Sichuan Baicha Baidao Industrial Co, aims to raise around HKD$2.46 billion at a planned share price of HKD$17.5, which would give them a price-to-sales (P/S) ratio of 1.4x – double that of Nayuki. This suggests that the market is still figuring out how to value these tea chains properly.

Lack of understanding from investors: The bubble tea market, while growing at a rate of 12% in the US and 8% in Europe per year since 2018, is still relatively underdeveloped in these regions. Additionally, the target market for bubble tea is typically 20-35 year olds, which may not align with the demographics of many institutional investors. This lack of familiarity with the industry and its target audience may contribute to the undervaluation of companies like Nayuki.

Competitors

The freshly-made tea shop industry in China is fiercely competitive, with several major players striving to capture a larger share of the RMB247.3 billion (approximately $36.5 billion) market. The top five companies in this sector account for about 40.2% of the total market share. Three of these leading companies – Mixue, Guming, and ChaPanda – have recently filed for initial public offerings (IPOs) to raise funds and expand their operations. ChaPanda swill list on the Hong Kong stock exchange on April 23, 2024.

As of September 2023, Mixue had the largest store network with 36,000 outlets, including around 3,000 stores in international markets. Guming followed with approximately 9,000 stores, while ChaPanda had 8,016 outlets. These companies have experienced impressive growth in recent years. In 2023, Mixue's revenue grew by an astonishing 46%, with profit margins of around 15%. Similarly, ChaPanda's revenue increased by 35%, with slightly higher margins of about 20%. These figures indicate that both companies have been successful in attracting customers and generating profits.

Most of these tea shop chains have relied heavily on franchising to rapidly expand their store networks. A staggering 99.8% of Mixue's stores and 99.5% of ChaPanda's outlets are operated by franchisees. In contrast, Nayuki has primarily focused on self-operated stores, which are owned and managed directly by the company. While this strategy has given Nayuki greater control over its brand image and product quality, it has also limited the company's ability to expand as quickly as its competitors, particularly in lower-tier cities where franchising has been a key growth driver for competitors.

However, Nayuki's emphasis on self-operated stores and its positioning in the high-end market have allowed the company to achieve the highest gross margins in the industry, at around 40%. In comparison, Guming's gross margin stands at 31%, while ChaPanda's is 35%.

Furthermore, Nayuki's selective approach to store locations and its premium positioning have enabled the company to generate nearly twice the daily average sales volume per store compared to ChaPanda.

Nayuki's most significant competitor is HEY TEA, another high-end brand that has recently adopted a franchising model to accelerate its expansion. Since November 2022, HEY TEA has opened an impressive 2,300 stores, establishing itself as the largest player in the premium freshly-made tea market. Customers generally prefer the higher end brands.

More details on Nayuki

Target market and Store Ownership

Nayuki focuses on the higher-end market with its customer base primarily consisting of women aged 30-35, which is older than most other bubble tea stores. There is also a focus on healthier alternatives as demand is rising and they are working to bring no-sugar alternatives to the market. As previously mentioned Nayuki relies currently on self-operating stores.

Expansion and Franchising Strategy

Nayuki has recently started expanding into Tier 2 cities and has minimal presence in Tier 3 cities. However, their recent openings in these cities have shown similar profitability to Tier 1 cities. Store-level operating margins are 19.6% for Tier 1 and Tier 3 cities, and 18.1% for Tier 2 cities. To accelerate growth in Tier 2 and Tier 3 cities, Nayuki began franchising in July 2023.

Franchise Growth and Agreement Updates

Franchise store openings have been slow, with only 104 franchise stores opened in Q1, which is traditionally the slowest quarter. To boost growth, Nayuki updated their franchise agreements in February 2024, reducing the investment requirement by half to RMB580,000. Compared to competitors like Mixue, which has the highest franchise investment requirement at RMB500,000, Nayuki's previous requirements were too high. They also optimized equipment space, reducing the required store size from 90 to 40 m2, providing more options while maintaining a premium feel. Currently, 400 prospective franchised stores are being processed.

Expansion Plans and International Growth

Nayuki plans to open around 200 self-operating stores in 2024, alongside a cautious overseas expansion and hundreds of franchise stores. However, they are currently behind this target. In 2023, Nayuki opened their first store in Thailand, with prices 20-30% higher than in China, which has been successful so far. They will continue to use self-operated stores in new markets and then utilize franchisees to expand further once they achieve scale.

Membership Program and Store Growth

Nayuki has a membership program with 4.7 million monthly users and a repurchase rate of 23.9% (members who ordered at least twice a month). In 2023, total stores increased by 506, and management expects higher growth in 2024 by making franchising more attractive.

Product Focus and Financial Position

Nayuki focuses on premium fresh fruit tea and is developing no-sugar alternatives to meet the growing demand for healthier options. The company is financially strong, with RMB2.98 billion in cash and deposits and no interest-bearing borrowings. Despite trading at low multiples (0.7x P/S and 0.7x P/TB), Nayuki is growing revenues at 20%.

The company has also been buying back around 5.38m shares in 2024. That isn't a great buyback, but it is a beginning.

Risks

The risks are fairly obvious. Competition is fierce and if they fall too far behind or if their brand image gets damaged, they would suffer a significant amount of loss in sales. Furthermore the company operates in China and is listed on Hong Kong, so that is an additional risk for many western investors.

Conclusion

In conclusion, Nayuki looks good here due to its current undervaluation, unique business model, and strong growth potential in the expanding bubble tea market. The company's focus on self-operated stores and premium offerings differentiates it from competitors, while its recent adoption of franchising positions it for accelerated growth. As investors gain a better understanding of the industry and Nayuki's long-term prospects, the company's valuation is likely to appreciate. Please always do your own research.

https://www.ft.com/content/7cd22551-22cb-4777-8d4d-e79be48f143d

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0415/2024041500022.pdf

https://www1.hkexnews.hk/app/sehk/2024/106124/documents/sehk24010203325.pdf

I included your write-up in my Emerging Market Links + The Week Ahead (April 29, 2024) for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-april-29-2024

However, Sichuan Baicha Baidao Industrial (HKG: 2555) aka Chabaidao just had an IPO and apparently it was a dud and there are yet more bubble tea IPOs in the pipeline... Mixue has outlets here in Kuala Lumpur - reasonably priced too but have not tried anything yet... They always seem to have new things advertised...

For Tanjin developments why is mean reversion a thesis? Is there a catalyst for it to mean revert? Like I feel like "mean reversion" as a thesis could apply to any number of Chinese stocks.