On Coal & Oil and Shorting Credit Acceptance Corp

Why a sub-prime lender presents a nice shorting opportunity.

This piece is an opinion and for information purposes only, and it isn't investment advice. Seek a duly licensed professional for investment advice.'

Most of my predictions turn out to be wrong. My coal prediction luckily wasn't. In my write-up on Thungela (where I missed a 5x, due to selling to early), I wrote:

While demand is still increasing, supply is going down. The United States coal production slumps to volumes last seen in the 1960s. As coal production in Eurasia, the European Union, and South Africa is declining, there might be an even more significant supply/demand discrepancy than what we are already seeing. Permits for new coal mines have become pretty much impossible in most western countries. The returns of coal companies in the next decade might be similar to those of tobacco companies from 1990-now.

That theory just got a leg up as Europe scrambles to restart their coal plants. Germany will pass emergency laws to reopen coal plants as Moscow starts to weaponise its gas. The IEA chief even warns Europe to prepare for a total shutdown of Russian gas exports. As Germany turns down their nuclear reactors, coal is on the rise. My home-country Austria, returns to coal as well. Where we celebrated the coal exit in 2019, reality sets in.

Meanwhile a heatwave is testing Europe's energy system and demands even more energy from a strained continent. However coal, is only a temporary solution - at least according to the politicians.

“Nothing is so permanent as a temporary government program.”

― Milton Friedman

I don't believe that this will be temporary. While the energy consumption in the west is already at a high level and thus not rising as quickly as the demand from Asia and Africa, it isn't shrinking either. Coal is hated, but it is not under as much government scrutiny as oil.

Regarding Oil - Javier Blas, a great commodity market analyst - wrote in his latest Bloomberg piece that OPEC+ is struggling to increase supply as the demand is rising Post-Chinese lock-down. It's an excellent piece worth a read.

Here is also a great paper about the current energy landscape, Europe and renewables from JPM Morgan.

Shorting Credit Acceptance Corp

Interest rates are on the rise, and as a result sub-prime lenders such as Affirm and the private Klarna saw their valuations erode. Credit Acceptance Corp is an auto-finance company in the sub-prime space, that I wasn't aware of. That was until the awesome interview with Mohnish Pabrai. Mohnish seeing the returns of Credit Acceptance Corp presented the idea to Charles Munger, who dismissed the idea instantly - stating it is not a win-win-win situation.

When Charlie dismisses something, it is worth studying. What I found seems eerily similar to the Carvana "Drivetime" financing. Thanks @blue_chip1, @johngaltier45, @AnadarkoCapital, @PlainSite for all the great research on it.

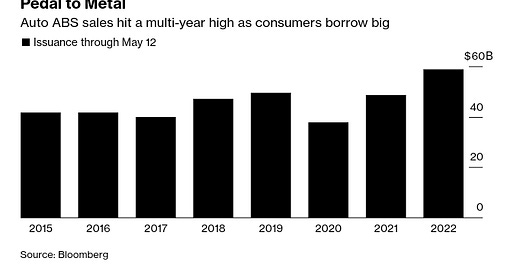

Credit Acceptance Corp or CACC for short, repossesses around 35% of their cars. That fits with their expected collection rate of around 66%. Not only that, but 91% of their customers have under 650 or no FICO score. That is crazy. At the same time, these companies package the loans into Asset-Backed Securities and sell them.

When that sound familiar, sub-prime mortgages and their Asset-Backed Securities that came with it, were one of the main causes for the 2008 Financial Crisis. While most things look dandy, it seems we are in late 2007 regarding the car-loan products as fundamentals are deteriorating.

Santander had to pay fines in 2020 as they underwrote sub-prime loans that had an expected default rate of under 70%. . Additionally the amount of fraud in car loans is huge and the default rates are rising. In February car loan defaults hit 8.8%,

CACC has been severely criticised before due to their opaque accounting and has even been investigated by the DOJ and FTC.

Short-seller Aaron Back wrote in 2017 that due to rising defaults and the high valuation, the company might have problems. However, I believe that now is the time. Inflation hits the poorest first, and those are exactly who CACC targets. Low interest rates allowed CACC to borrow at around 5% and give their customers up to 24% interest rate according to Detroit Lawyers. As we can see from their 10k, it seems that their loans got riskier as the time went on going from a 73% collection percentage in 2012 to 67% last year. Credit Acceptance's regulatory filings show it is under scrutiny in 44 states. Incredible. The predatory nature also becomes apparent during the pandemic. Many auto-lenders offered deferrals, but the biggest one CACC did not.

Here is another great article from 2016 about the predatory behavior of CACC and a podcast from 2019. The best write-up is on plainsite. They explain in detail the exploitative nature of CACC's business, their seemingly illegal behaviour and wild past. It's not a sub-prime lender with a moat, or technological advantage.

In Detroit, Michigan thus far in 2017, nearly one in eight of all available civil lawsuits filed in the city involve Credit Acceptance suing borrowers. Overall, 72% of these lawsuits resulted in the company garnishing the wages or tax refunds of borrower.

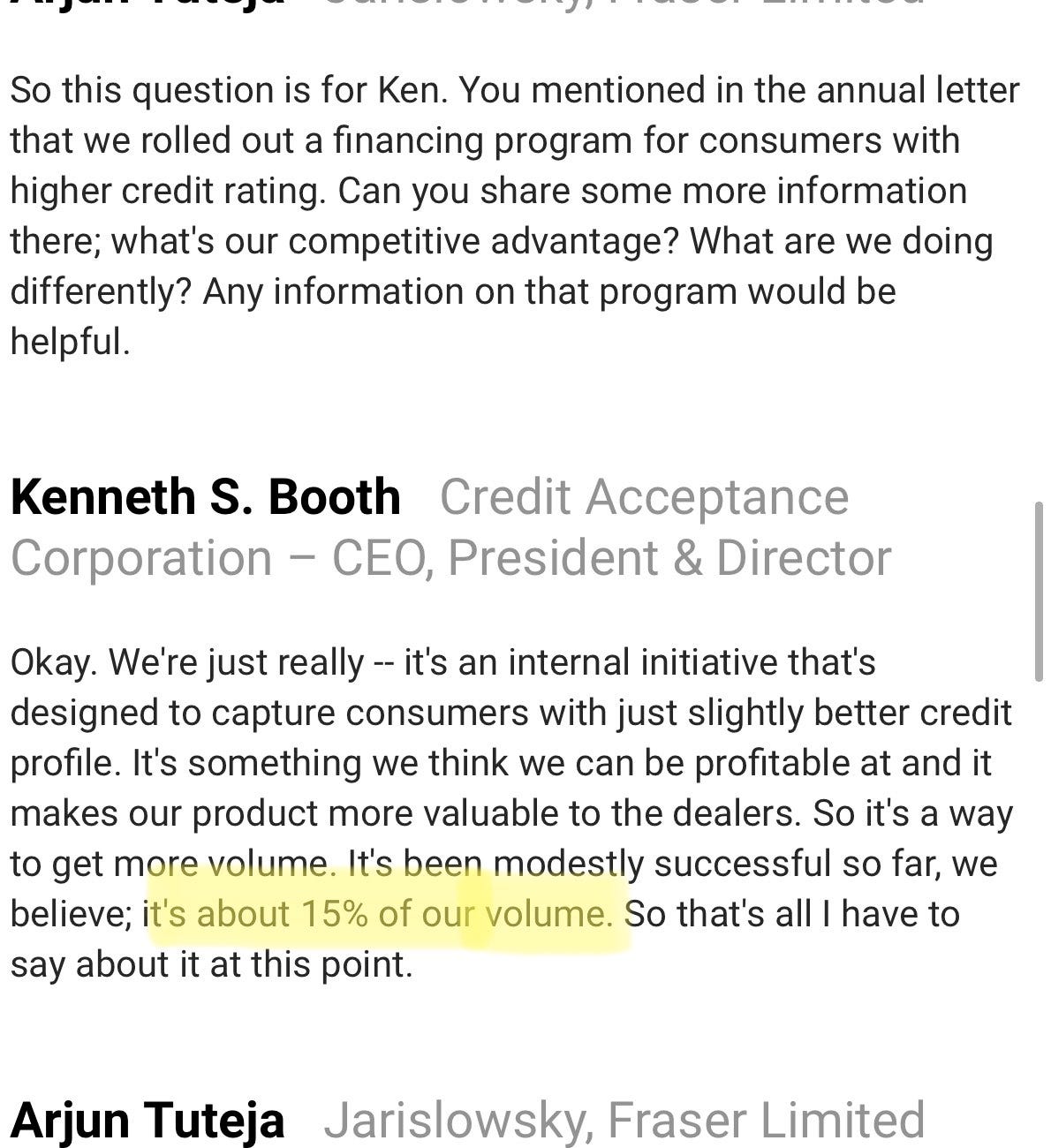

Furthermore, the company is changing its business model, rolling out credits for customers with higher credit. That is around 15% of the volume according to their CEO on their latest earning call. When asked about the return on assets or equity, the CEO dodged the question - saying that they don't talk about how much they make on various programs. So much to transparency. In the higher credit market, the company faces tough competition and banks like Ally.

As the price of new cars rises, so will the interest rates. We are already seeing that new car payments have increased exponentially. How many months will it take until we see CACC's loans deteriorating even more?

Additionally it seems that their credit ratings get worse. Given that junk-bond yield are at 8.8%, while CACC's bond portfolio is around 5% - we can expect a heavy decline in profits as the spread between customer (or victims) and CACC's interest rate closes.

Additionally they guided a $54 million reduction in future cash flows - not great.

Insider Selling and High Valuation

To every enrichment scheme, there must be insider selling. At Carvana the management team sold over $3 billion from 2020-2021 and CACC seems to be no exception here. Management is selling at these prices, which are around 4.1 P/B. An absurd valuation for what is a sub-prime lender.

And boy was there selling. The management team since 2018 sold more than 560m in stock.

The only insider who bought stock the last few years was the CFO, who bought $2.7m worth of shares in 2019 and 2021 and that doesn't mean a thing, since he sold close to $8m in shares in the same time frame. He also was a Senior Manager at the now dissolved Arthur Andersen.

At the same as insiders are selling, the company is buying back stock - providing liquidity for them as the stock is thinly traded for a company with a market cap of over $6b. That lead to a rising stock price since 2018.

Conclusion

Given the high valuation, insider selling and the current macro environment of high inflation and rising interest rates - I think that CACC looks like a decent short. Might not tho - as I said, I am more often wrong than right.

How much do you think regulation will play into it? Do you have a price target?