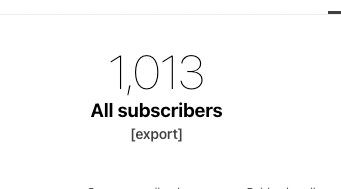

Over 1000 subscribers ! What makes a mistake a mistake in Investing and the most obscure stocks ... in the world

Learning from the Market Wizards

Hello and a good weekend to everyone.👋

When I started writing 1 1/2 years ago, I thought that I would be lucky if 10 people read my ramblings – now there are over 1000! Thanks to every one of you that continues to read my thoughts. If you have any suggestions or questions, feel free to ask them.

I have written in the past that I expect coal to fall similarly like oil did, and as I am fairly concentrated I reduced my position. After extensive research, I bought the silver basket that I outlined in another post. I also think that many basic metal miners look incredibly cheap at the moment.

I recently got asked why I am switching up my approaches. I am just learning and trying out what approach fits me best. There is so much of what I don't know. I am trying to take in as much as possible.

News

Google Layoffs

Google has recently announced the layoff of over 12,000 employees, or 6% of their workforce. This is what they wrote:

Over the past two years, we’ve seen periods of dramatic growth. To match and fuel that growth, we hired for a different economic reality than the one we face today.

Wall Street liked the move as the stock rose over 5% or over 8b in market cap. I disagree. Management over-hired when demand was pulled forward enormously due to the pandemic, and they couldn't perceive an environment other than it continuing? The CEO gets paid around 100 m a year if you include the stock warrants, and they did not see that growth was slowing at the end of 2021? Mhm…

Finally, cutting spending is incredibly difficult. All the systems and hierarchies in place were often made for a certain number of workers. These need to change in order to fit the new requirements for the company. Furthermore, companies that grow fast frequently don't have a proper spending discipline. Other than a small blip in 2014 and two during the pandemic, Google did not have a quarter of negative operating earnings in a decade. That speaks volumes about the quality of the company—but I also think that it will be difficult for them to effectively reduce costs.

Brazil

The Lula appointed president of Banco do Brasil confirmed a 40% dividend payout of net income for 2023. It was 36% in 2022. That is great news. The rhetoric of the media was that Lula will stop dividends of partly state-owned companies. It appears that that isn't the case. Great news for my position in Petrobras.

Learning from the Market Wizards

I recently re-listened to the Market Wizard series by Jack Schwager. In it, he interviews dozens of traders with different styles. It is a great way to learn and expand the investment horizon. Since there are so many approaches, the lessons learned are different each time I re-listened to it.

Nearly every trader mentioned that an independence in research and how to approach the market led to their success. Whether you use technicals, fundamentals or other factors to invest, you should stick to your style that incorporates your strengths and weaknesses as a person. Some people are short only, while others shudder at the mere thought of it. Be independent and question the conventional thought that is the prevailing in the current market environment.

Expect the extremes. The market can make much wider swings than you can imagine. History is a good guide of what is possible, but use it as guide, not as gospel.

Technical analysis is a great tool to add to the fundamental picture. Most chart patterns don't work. It tracks the past, not the future, and tells you how the market perceives a stock. It is like a thermometer for a doctor, it doesn't predict the future, but you want to know where the market is.

Change your opinions quickly. Strong convictions loosely held. Don't trade too much (I am guilty of this) and wait for the fat pitches to come.

Always assume that the person at the other side of your trade also has some idea of what they are doing. Always protect your downside, think of what you can lose—not what you can gain.

What makes a mistake a mistake in Investing

Around Twitter, there have been several discussions. Bill Ackman was wrong about being wrong on Netflix, or that Icahn made a mistake selling Apple. Personally, I sold YPF where the calls would have more than doubled after selling them. So, were those mistakes or not?

The Market Wizards mentioned one other point: You can have a good trade and lose money, or have a bad trade and make money. This is of course possible if you bought into a company and didn't do your usual investment process—but were lucky to make money, or you could have followed your process and lost money.

You should review the investment process, especially if one left gains on the table—but if the investment process was followed, it wasn't a mistake. For me, YPF became too large of a position and the valuation spread between it and Petrobras and Ecopetrol narrowed. It was a no-brainer to sell from a risk management perspective. While I will now scale out of positions, instead of selling it quickly—the investment process at the time was not an error.

The same can be said about Icahn selling Apple. He invested in it and got a 50% return in less than two years after pushing for share-buybacks. Icahn doesn't hold many for long, he creates the returns through his activism and then sells. So, based on his investment process, that wasn't a mistake—despite Apple's share price appreciating immensely.

Ackman and Netflix

Since Ackman sold Netflix, it is up more than 50%. So, was it a mistake? Here is an except on what he wrote in his letter to shareholders:

While we have a high regard for Netflix’s management and the remarkable company they have built, in light of the enormous operating leverage inherent in the company’s business model, changes in the company’s future subscriber growth can have an outsized impact on our estimate of intrinsic value. [...]

We require a high degree of predictability in the businesses in which we invest due to the highly concentrated nature of our portfolio. While Netflix’s business is fundamentally simple to understand, in light of recent events, we have lost confidence in our ability to predict the company’s future prospects with a sufficient degree of certainty. Based on management’s track record, we would not be surprised to see Netflix continue to be a highly successful company and an excellent investment from its current market value. That said, we believe the dispersion of outcomes has widened to a sufficiently large extent that it is challenging for the company to meet our requirements for a core holding.

Looking through Ackman's portfolio, the cashflows of the companies are very predictable. Since Netflix changed its model trying to grow with an ad supported tier, he couldn't do that anymore and sold. The price changed, but Ackman stuck to his investment philosophy. It wasn't a mistake.

The most obscure stocks.... in the world

I asked on Twitter, what are some obscure stocks. There were some great answers. Here are the best ones. I will publish my research into those that I find the most interesting.

Veon: 13th largest telecom in the world by accounts. Operates in Russia.

K2 LT: Cremation in Lithuania

Italtile: South African tile company.

GKP.L: Oil producer in Kurdistan

INNER MONGOLIA YILI INDUSTRIAL (600887): Mongolian milk producers

Viscofan: Salami/Sausage Castings

Iraq Oil Stock: Forza Petroleum

Dream International: Korean owned Vietnamese toy stock

FDV. ASX: Pakistani Real Estate Sales Portal

Yukiguni Maitake or Hokuto Corp: Japanese Mushroom grower.

Nagacorp Ltd: Casino in Cambodia

Bank of Georgia: Biggest bank in the country of Georgia.

Black Iron: Ukrainian iron ore producer

Erin Ventures Inc: Boron in Serbia

Contango Holdings: Pre-production Zimbabwean coal company

Astara Holdings: Ukrainian Agricultural company.

I am not interested in Ukrainian or Russian companies due to the uncertainty. Nagacorp - the casino in Cambodia isn't cheap enough given the high dilution, low dividend and uncertainty of customer returns after the pandemic in my opinion. Erin Ventures doesn't have revenues yet, so it is a pass for me.

A tile company is too dependent on housing, and good housing stocks are cheap in the US—so I pass here. Viscofan and the Japanese mushroom growers are too expensive for me as well. While the story of a Pakistani real estate sales portal sound enticing, the companies loses are increasing. It might be obscure, but it doesn't look like an enticing investment.

Bank of Georgia is interesting. It looks cheap on all levels. The problem I have with banks, is that they are like black boxes—you can never know for sure what liabilities and risk they might be exposed to. We saw the extreme end of this during the financial crisis of 2008, and in emerging markets there might even be more risk—so I pass. However, if you know more about Bank of Georgia and have some info, please message me!

K2 LT is the only crematorium in Lithuania with just 8 million market cap. The company is cheap and very thinly traded. They obviously have a real, local moat. I will do more research into this company. Contango Holdings is a coal company, so I will definitely dive into them. Both GKP.L and Forza Petroleum are incredibly cheap, and I will analyze them as well. The Mongolian milk producers sounds cool, but it's too expensive at first glance. Dream International looks cheap and grows quickly, so I'll have a look at them as well.

Congrats on 1000 subscribers!

Glad to hear you bought the silver basket. A lot of overlap with my own. A question: What led you to give Kuya such a (relatively) high weighting at 5%?

Re Bank of Georgia: I haven't looked at it, but I would be mindful that Georgia was a huge beneficiary of Russians fleeing from the war and money flowing in to Georgian banks during 2022. Some will go back to Russia, some will use Georgia as a temporary base and will immigrate to more attractive jurisdictions, so there is definitely a one-off effect here.